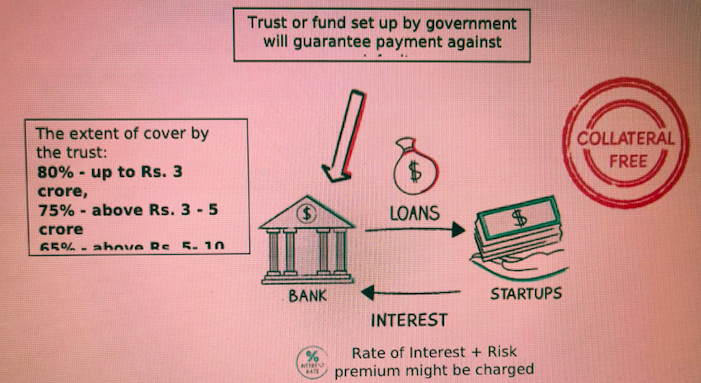

Businesses develop on account of the availability of capital .When fund crushes happen ,it gravely effects the business flow and plans of aspiring entrepreneurs .The Department for Promotion of Industry and Internal Trade (DPIIT) has notified credit guarantee scheme for startups for providing the much-needed collateral-free loans. Loan/debt facilities sanctioned to an eligible borrower on or after October 6, would be eligible for coverage under the scheme. The scheme aims to provide support to startups that have been badly hit by the pandemic and are now likely to be further affected due to the rising interest rate scenario and liquidity is not likely to be readily available to new entrepreneurs.

Purpose of the scheme: guaranteeing payment against default in loans or debt

Criteria to apply :

Who can lend credit under Credit Guarantee Scheme for Startups, i.e. Member Institutes (MIs):

Transaction - Based

Umbrella-based

The umbrella-based guarantee cover will provide guarantee to Venture Debt Funds (VDF) registered under AIF regulations of SEBI, in view of the nature of funds raised by them and debt funding provided by them. The extent of umbrella-based cover will be the actual losses or up to a maximum of 5% of Pooled Investment on which cover is being taken from the fund in eligible startups, whichever is lower, subject to a maximum of Rs.10 crore per borrower.

The lending institutions will evaluate credit applications by using prudent banking judgement and shall use their business discretion/due diligence in selecting commercially viable proposals and conduct the accounts of the borrowers with normal banking prudence. These institutions will also closely monitor the borrower account. The MIs will prioritize the commercial value for proposals seeking financial aid. Along with institutional mechanisms for operationalizing the Scheme, DPIIT will be constituting a Management Committee (MC) and a Risk Evaluation Committee (REC) for reviewing, supervising and operational oversight of the Scheme. The National Credit Guarantee Trustee Company Limited (NCGTC) will be operating the Scheme.

Status of Startups in India

Conclusion

This scheme is initiated amidst a massive funding decline for startups. Indian startups raised $ 752 million in September 2020, which is 83% lesser than the same period last year. The funding slowdown is expected to continue for the next 12-18 months and the effects of the funding slowdown are expected to intensify , as the world anticipates a recession and are making preparations to cut costs. The aforseaid Scheme will be a significant boost to the startup ecosystem. It shall catalyze entrepreneurship through credit to innovators and encourage banks and other member institutions for providing venture debt to startups.

© 2026 Business Consultant & Law Firm - Legacy Partners. All Rights Reserved.

Designed by Nuewelle Digital Solutions LLP

Legacy Partners

We typically reply in a few minutes